Non-Resident Loans

What is the price of the property?

Non-Resident Loans

We have helped over thousands of non-residents obtain financing for buying their Australian properties. Many large developers in Australia have appointed us as their trusted finance broker especially for non-resident loans.

Non-residents looking to buy property in Australia have the option to take out a non-resident investment loan from an Australian non-bank lender. Non-residents are also required to pay a foreign buyer duty which is determined by the state in which they purchase the property. Non-bank lenders also usually offer more flexibility than most banks when it comes to approving finance for overseas buyers as well as accommodating other banking needs. Non-residents looking to invest in property in Australia should seriously consider these investment loans offered by non-bank lenders as an efficient way of financing their purchase.

Key Aspects for Foreign Individuals Buying in Australia:

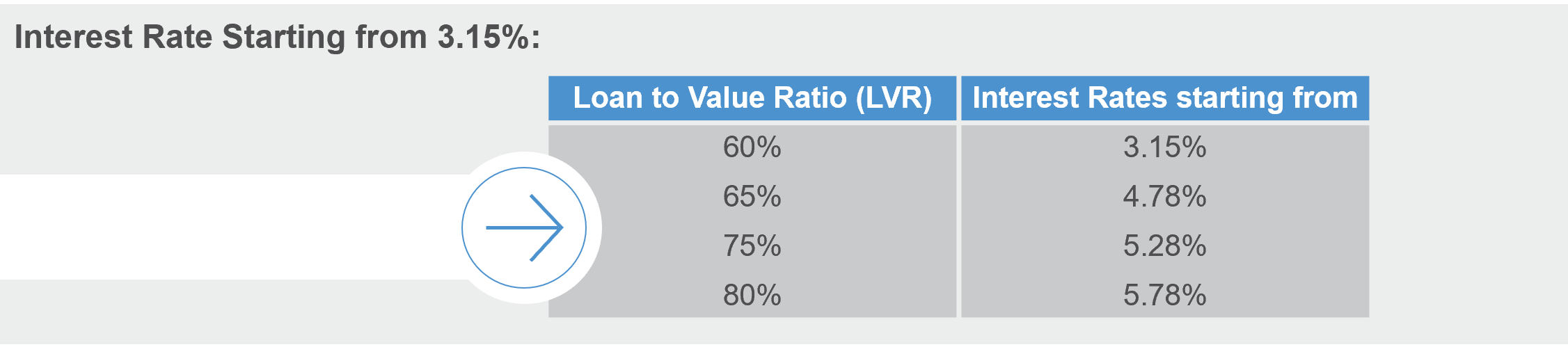

Maximum LVR – 80%

PAYG or Business Owners are accepted

If you are married to a Permanent resident/Citizen/Temporary resident in the accepted visa list please refer to our Expat Loans section

Wide range of acceptable countries (Brunei, Canada, China, France, Germany, Hong Kong, India, Indonesia, Japan, Macau, Malaysia, New Zealand, Saudi Arabia, Singapore, South Africa, South Korea, Switzerland, Taiwan, United Kingdom (England, Scotland, Wales, Northern Ireland), United Arab Emirates, United States of America, Vietnam.)

Foreign Investment Review Board (FIRB)

Non-residents interested in purchasing real estate in Australia must get approval from the Foreign Investment Review Board (FIRB) prior to making any purchase. The application process for the FIRB requires Non-residents to answer a series of questions about their property purchase, such as the ownership structure and financing arrangement, in order to determine whether they are eligible to buy. Once approved, Non-residents can rely on the reassurance of FIRB review when purchasing property in Australia, as every Non-resident will receive an individual assessment and application tailored by experienced staff who can give advice and help guide Non-residents through the entire process.

Since 2015, a feature of Australia's foreign investment approval regime has been the requirement for investors to pay an application fee to have their proposal considered by the FIRB. On and from 29 July 2022, FIRB application fees are set to double.

This means that:

A transaction involving residential land valued at $2 million or less will now attract an application fee of $26,400 (up from $13,200);

A share sale with a value of $100 million or less will attract an application fee of $26,400 (up from $13,200);

A share sale with a value of AUD $500 million or less will attract an application fee of $237,600 (up from $118,800);

Transactions with a value of $2 billion or more will attract the maximum fee, which is now set at $1,045,000 (up from $522,500); and

The fee for internal re-organizations is now a flat fee of $26,400.

Click Apply Now to find out more.

FAQs

Banks/lenders have their own target market. A finance broker expert can assist you in deciding which bank/lender products best suits you.

However, if you could satisfy the lender's mortgage insurance (LMI), then you may be able to borrow as much as 98% LVR including LMI.

SC Brokers have extensive knowledge and experience in providing finance for off-the-plan properties, whether it is an apartment, townhouse or house & land package. We ensure sufficient work is carried out at an early stage for the valuer to know better about the project to provide a better result.

Our multi award-winning team will ensure that your receive the best service possible.

If, in the unlikely event the builder has gone into trouble, please contact your finance broker asap to extend the construction period for the loan and send us the new building contract for valuation. Your loan, in general, will not require a re-assessment to confirm the borrowing capacity.