Commercial Property Lease Docs

How much funding do you require?

You may find it is tough to get a bank/lender to provide loans to the self employed, especially when you are looking to purchase a commercial property.

However, this has changed quiet a bit in the recent years. We now have banks/lenders will consider cut down the paperworks needed under lease doc loans. This is when the purchasing property has a lease in place for a certain number of years.

How does a lease doc commercial property loan works?

A lease doc commercial property loan does not require to see full financials of you and your businesses. Banks/lenders are assessing the loan based on the rental income of the property alone.

Here are a few key factors -

No payslips, tax returns, financials or BAS to be provided

Borrow up to 70% LVR

It must be a commercial property, such as retail shops, warehouses and offices.

The lease has to be more than 12 months remaining.

The lease must be at "arms length", so it cannot be your relatives, or your own company.

Usually the rental income has to cover at least 1.5x the repayment

The maximum loan amount in general cannot be over $3m.

How does the lender assess the lease?

The terms of the lease, for example how many yrs left. If any special conditions

The strength of the tenant

The interest coverage ratio

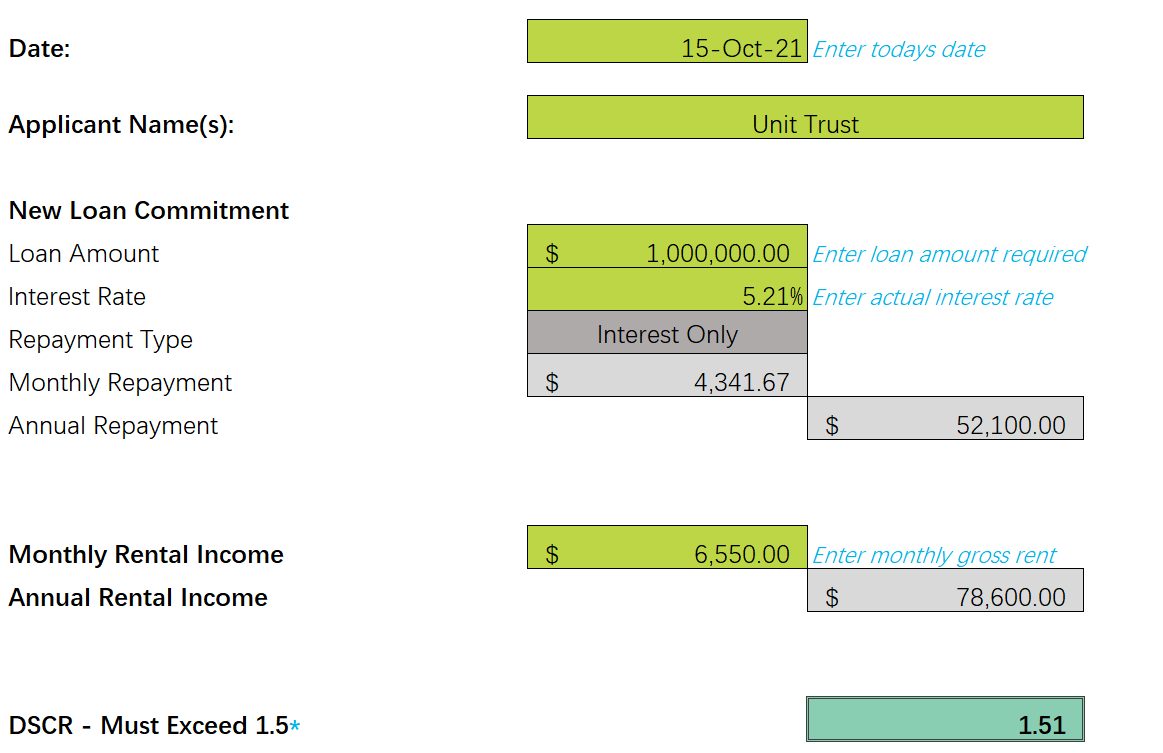

As the minimum interest coverage ratio has to be 1.5x, this means your rental income has to cover at least 1.5x the interest only repayment.

Below is an calculation of our lender will calculate the borrowing capacity.

So a $1m loan at interest rate of 5.21%p.a, we will need to see approximately gross rental income of $78k.

Who are the lenders that will offer lease docs?

To know which bank/lender will offer lease docs to buy commercial properties, please contact one of our finance brokers. We are more than happy to give you some guidence.

You can lease a message to us by completing the contact us form.