Bridging Finance

Buying? What is the price of the property?

Building? What are the land and construction costs?

Bridging Finance

It’s never been easier to buy or build a new home before selling your existing property. We have market leading bridging solutions that are fully featured and as user friendly as they come.

You also get stand out features including:

Loans at our advertised rates (no rate loading), including fixed rates.

A 100% offset facility that can help save on interest while paying down your loan quicker.

Loan servicing capability based on the (end) debt you have once your home is sold (for loan to valuation ratios less than 80% only).*

No repayments required while your existing home is onsale (the bridging period) as interest is capitalised.**

Suitable for owner occupiers and investors.

Real valuation values used without buffering for risk.

No fixed rate penalty at time of partial discharge (i.e. when your loan is paid down, completing the bridging phase).

2nd mortgage options available on property to be sold.

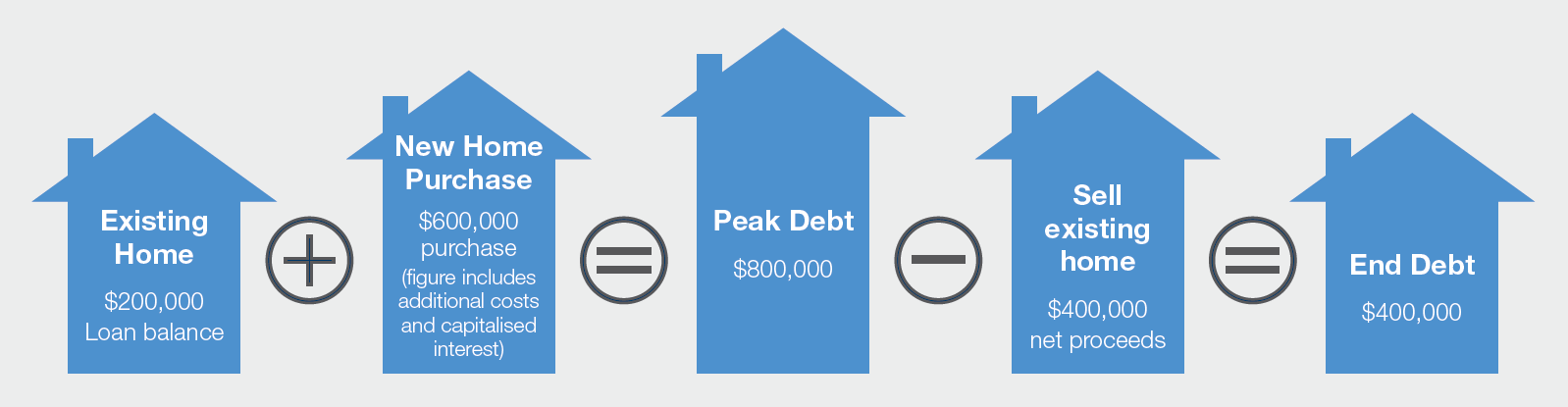

What is the Bridging Finance?

Bridging finance, also known as bridge loans, is a short-term loan that provides temporary financing for a specific purpose, such as buying a new property while waiting for the sale of the current property. The loan is usually secured by the property being sold and is used as collateral to secure the loan. Temporary loan is a popular solution for property buyers and developers who need quick access to funds and need to close a gap in their finances.

Bridging loan is typically used to finance property transactions, but it can also be used for other purposes, such as refinancing, debt consolidation, or even business expansion. This type of loan is often sought after by property buyers and developers who need to secure funds quickly to complete a property transaction. It provides them with a fast and flexible solution for obtaining the necessary funds, without having to wait for the sale of their current property.

What are the Advantages of the Bridging Loan?

Short-term finance offers a number of advantages over traditional lending options. Firstly, it provides quick access to funds, allowing property buyers and developers to secure their financing and complete their transactions quickly. This is particularly important for property transactions, as the market is often fast-moving and buyers need to act quickly to secure a property.

Another advantage of fast property finance is that it is usually more flexible than traditional lending options. This is because it is tailored to meet the specific needs of the borrower and is designed to accommodate the unique circumstances of each transaction. This means that borrowers can secure the funds they need, when they need them, without having to wait for traditional loan approvals.

Bridging Loan also offers more lenient credit requirements than traditional lending options, making it a viable option for those who may not meet the stringent requirements of traditional lenders. This is because quick property finance providers are more focused on the value of the property being sold or refinanced, rather than the creditworthiness of the borrower. This makes it an ideal solution for those who may not have a strong credit history or those who may not meet the income requirements of traditional lenders.

Click Apply Now or Contact Us to have our broker contact you.

*Loan to valuation ratio (LVR) must not exceed 80% for end debt servicing to apply.

**Bridging period up to 6 months for existing homes or up to 12 months for construction.

FAQs

Banks/lenders have their own target market. A finance broker expert can assist you in deciding which bank/lender products best suits you.

However, if you could satisfy the lender's mortgage insurance (LMI), then you may be able to borrow as much as 98% LVR including LMI.

SC Brokers have extensive knowledge and experience in providing finance for off-the-plan properties, whether it is an apartment, townhouse or house & land package. We ensure sufficient work is carried out at an early stage for the valuer to know better about the project to provide a better result.

Our multi award-winning team will ensure that your receive the best service possible.

If, in the unlikely event the builder has gone into trouble, please contact your finance broker asap to extend the construction period for the loan and send us the new building contract for valuation. Your loan, in general, will not require a re-assessment to confirm the borrowing capacity.