Construction Loan

How much are your land and/or construction costs?

Construction Loan

Building a home can be both an exciting and challenging journey, and we are here to make the process as simple and stress-free as possible. This guide covers the key points on how your construction loan will work.

For more information or to have our broker contact you, click Apply Now or Contact Us.

How does a Construction Loan work?

A construction loan allows you to access your loan funds at the completion of each stage of your build, meaning that you’ll only be paying interest on funds as you need them and not upfront on the full amount. These repayments are interest-only during the construction period and are repaid monthly.

Once your Building loan has settled, you’ll need to start your construction within 12 months, and have it completed within 12 months of drawing down your first progress payment.

To ensure that your construction is fully completed and ready to move in after the final payment, we will always make sure that we’re holding enough funds to complete each stage all the way through to the end. If you’re not borrowing the whole amount of the construction cost, and contributing funds of your own – you’ll need to contribute those funds first. Once all your funds have been contributed, our funding process will begin.

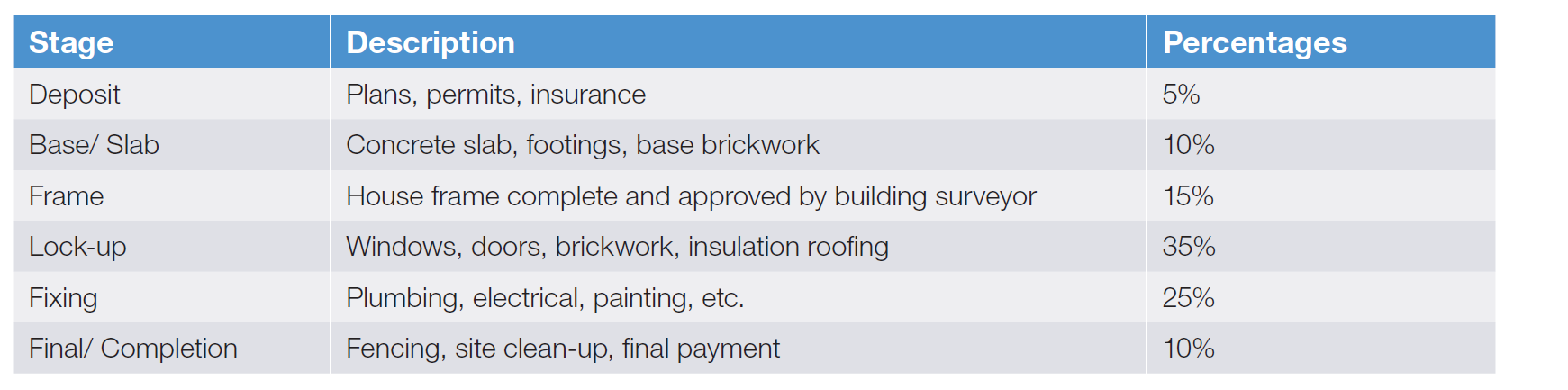

Typical Stages of Construction

(Note: The housing industry uses the following percentages as a baseline; these percentages are of a general nature and may vary.)

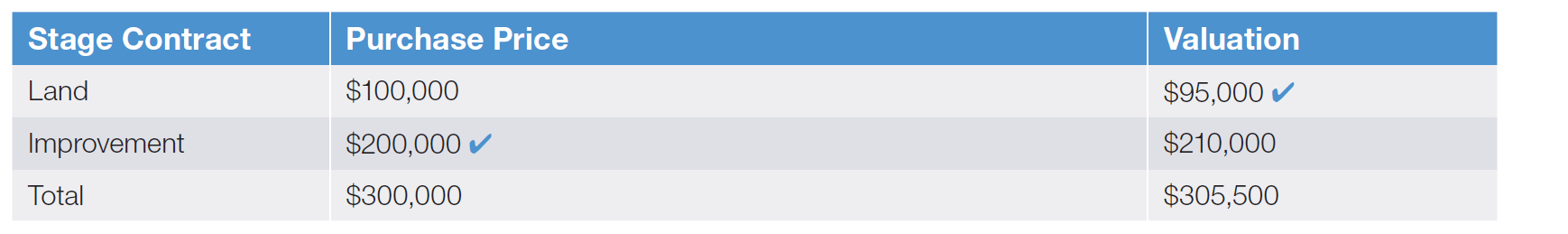

Construction LVR Calculation

LVRs are calculated by expressing the amount borrowed as a percentage of the security value. The security value for construction loan must be calculated using the following figures:

The lower of the land value shown on the valuation OR Contract of Sale PLUS

The lower of the improvement value shown on the valuation OR the Fixed Price Building Contract including any variations

In the following example, the security used to calculate the LVR is $295,000:

What’s required to get Construction Loan Approval?

A copy of the signed industry standard Fixed Price Building Contract (FPBC), as well as any quotes for extra work outside of the FPBC

As if complete Valuation – we, as your broker, can help you organise this

What Valuations are needed?

The Lender will conduct progress inspection valuations at the Base/Slab stage of your build or prior to our first payment contribution, and again at Final stage. Please let us know of any contact details for access to the site.

What's a Progress Construction Loan Payment?

A progress payment, or progressive drawdown, is a payment made at each stage of your construction. Before the Lender can release each payment, you’ll need to provide us with all the necessary documents outlined below.

To make your first progress payment we will need:

Copy of stamped and approved council plans (not necessary for deposit claim)

Copy of Builders All Risk Insurance or Certificate of Currency (on insurers letterhead and detailing borrower name, property address, and start/expiry date of policy)

Copy of Home Owners Warranty Certificate for an amount equal or greater than contract price (Tasmania excluded, BSA insurance in QLD)

Builder’s invoice(s) or receipt

Progress Payment Form signed by you authorising the payment

For finishing the job and making your final payment, we will need:

An Occupancy Permit, acceptable to the lender in respect of the building works, and any other permission that is required by any relevant authority in relation to the occupation of the land (not applicable in WA, Certificate of Compliance for SA)

A Building insurance policy or Certificate of Currency where the property value is greater than $1 million dollars. The amount should not be less than the value of the completed property

For all payments in between, we simply require a copy of the builder’s invoice and a signed Progress Payment Form.

Changes to Your Build or Builder

Where you have agreed to contractual changes with your builder, it is important to notify us immediately. Any variations, especially negative changes (i.e. swapping to lower cost materials or discounts from the builder) may impact the value of the security and require a new valuation.

Lenders are obliged to lend to you the amount of your actual construction costs. Any devaluation of the security may require a reduction of your loan amount.

We need to know immediately if for any reason you sign a contract with a different builder. We’ll need a newly signed and dated building contract, banking details, a copy of new builder’s insurances and any legal documentation relating to the original builder i.e. termination of contract. A new valuation may be required along with credit approval to proceed with the builder.

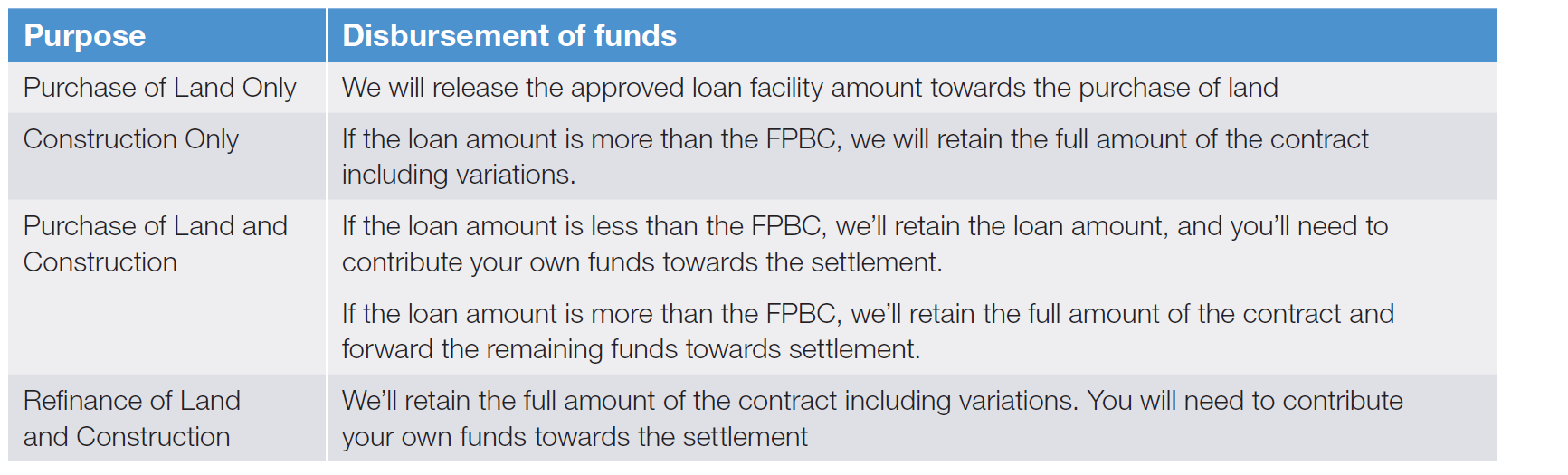

Settlement Scenarios – How Funds will be Disbursed

Where deposits have been paid, Lenders may release up to 5% of the FPBC amount prior to the commencement of any construction works. Funds will be made available towards land settlement.

Other things to consider:

All your progress payment claims need to be submitted in accordance with your building contract and can’t exceed the amount on the progress payment schedule. This is to ensure you have sufficient funds remaining to complete the build.

Lenders will only advance funds for works that have been completed and to the bank account nominated by the builder (cheque payments are not accepted).

Lenders will not be able to advance funds for materials that are purchased or delivered on site, but not incorporated into the structure of the build.

As set out in your loan terms and conditions, Lenders have the right to refuse to make a construction payment if at the time of request there is an event of Default.

If there are available redraw funds in your construction loan, you may request to access these funds by completing a Progress Payment Form. Please note that Lenders will assess your request and make a release of funds at their own discretion.

Can I use First Home Owner Grant (FHOG) funds towards land or construction or both?

Yes, you can use it towards land settlement or during construction; we can also process your FHOG on your behalf, and even have these funds available to be used at the settlement of your land or available at the base stage. Discuss this with us to ensure the Early Release FHOG form is completed and approved prior to your settlement. Please remember that FHOG cannot be used for land-only loans.

What’s the maximum I can borrow?

You can borrow up to 95% Loan to Value Ratio (LVR) for Vacant Land, and up to 95% LVR for Construction, inclusive of the Lender’s Mortgage Insurance (LMI) capitalization in both scenarios.

Can I apply for a vacant land loan without the intention to build?

Yes.

How many dwellings can be built on one title?

The loan can be used for one residential dwelling on one title.

What if my builder needs a deposit upfront?

We understand that your builder may require a deposit prior to the first progress payment, and for that reason, Lenders may allow up to 5% to be released to the builder at settlement. If you are refinancing or purchasing, please see the scenario table above.

If the deposit amount in the progress payment schedule is greater than 5%, we require the following documents prior to settlement:

Builder’s All-Risk Insurance

Home Owners Warranty Certificate

For more information or to have our broker contact you, click Apply Now or Contact Us.

FAQs

Banks/lenders have their own target market. A finance broker expert can assist you in deciding which bank/lender products best suits you.

However, if you could satisfy the lender's mortgage insurance (LMI), then you may be able to borrow as much as 98% LVR including LMI.

SC Brokers have extensive knowledge and experience in providing finance for off-the-plan properties, whether it is an apartment, townhouse or house & land package. We ensure sufficient work is carried out at an early stage for the valuer to know better about the project to provide a better result.

Our multi award-winning team will ensure that your receive the best service possible.

If, in the unlikely event the builder has gone into trouble, please contact your finance broker asap to extend the construction period for the loan and send us the new building contract for valuation. Your loan, in general, will not require a re-assessment to confirm the borrowing capacity.